Falling rental growth has been recorded for both units and houses across most of Australia’s capital cities, according to the Domain Group Rental Price Series Quarterly Report released yesterday.

National median weekly asking rents over the September quarter for houses decreased by 0.3 per cent, while unit rents fell by 0.4 per cent, the report said.

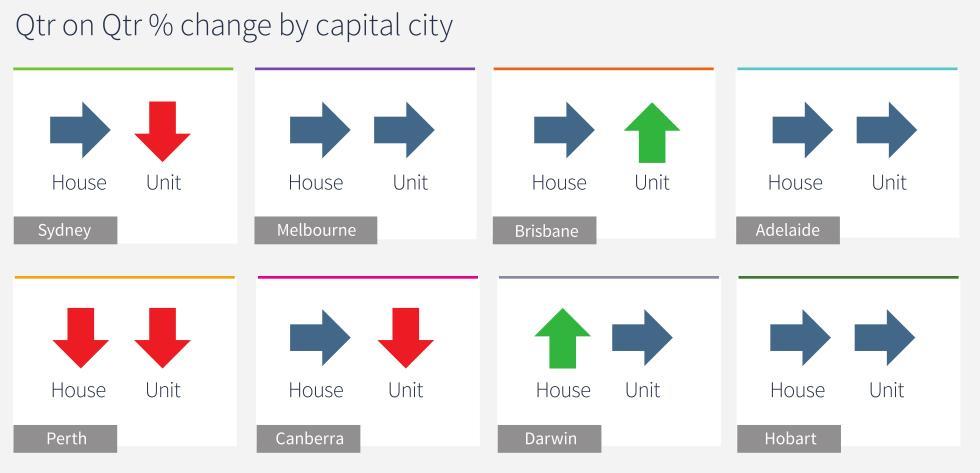

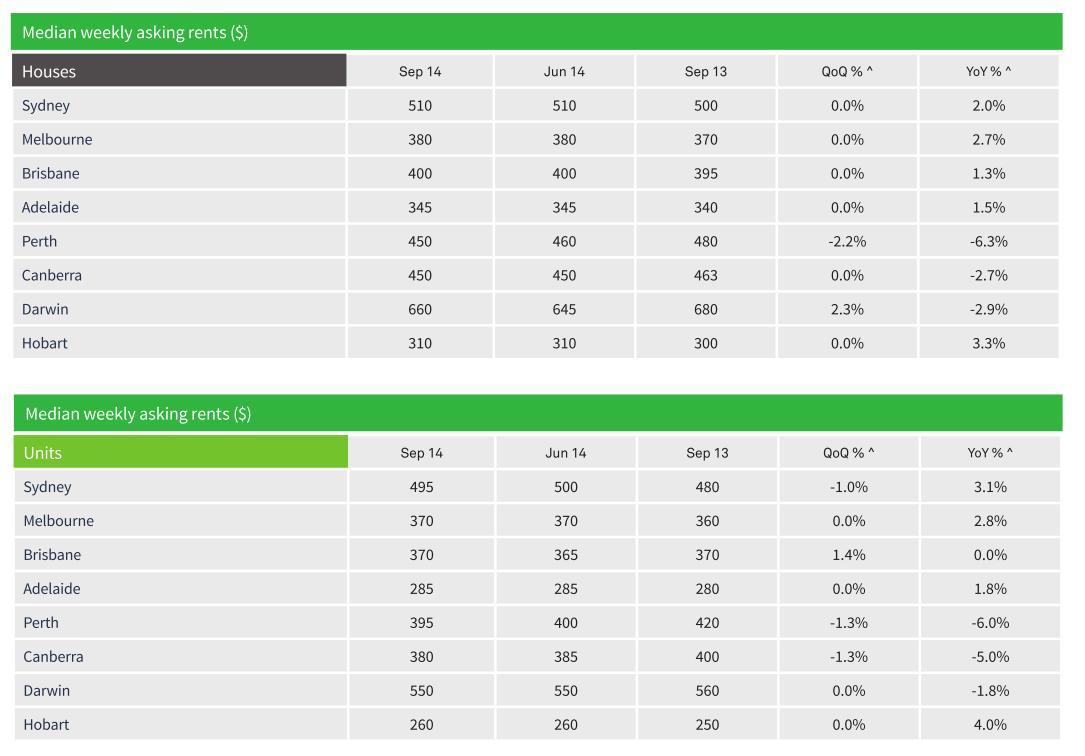

All capital cities reported steady house rental results over the September quarter, with the exception of Darwin and Perth.

Over the quarter, Darwin’s median asking rent for houses increased from $645 to $660 per week, while Perth’s house rent fell from $460 to $450 per week.

Unit rents fell in Sydney, Perth and Canberra while Hobart, Melbourne, Adelaide and Darwin all recorded flat unit rental growth over the September quarter.

Brisbane was the only capital city to see an increase in median asking unit rents, which increased from $365 to $370 per week.

Domain Group senior economist Dr Andrew Wilson said unit rents in Brisbane and house rents in Darwin were the only market segments to see an increase in the median weekly asking rent.

“Unit rents weakened in Sydney over the September quarter. However, the median asking house rent remained steady at the June quarter’s record level of $510 per week despite record levels of investor activity in the local market,” he said.

“Although we’ve seen a pause in rental growth over the September quarter, demand will continue to put upward pressure on rents in Sydney.

“In Sydney, yields are holding, asking rents are still strong and there is currently no sign of overshooting market fundamentals,” he added.

Mr Wilson said rental growth in other capitals is set to continue to move sideways at best, with the recent trend of rental falls in Canberra and Perth levelling off.

Source: Domain Group Rental Price Series Quarterly Report

Source: Domain Group Rental Price Series Quarterly Report

You are not authorised to post comments.

Comments will undergo moderation before they get published.