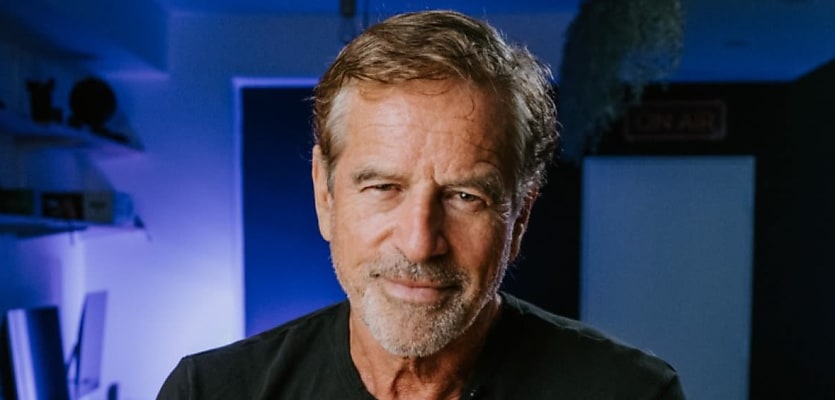

EXCLUSIVE Mortgage market pioneer Mark Bouris has warned real estate agents in NSW that they could be targeted by the state government for unpaid payroll tax.

Mr Bouris’ comments come after Revenue NSW — the division of the NSW government that collects taxes — contacted several mortgage aggregators and brokerages earlier this year seeking payment for backdated payroll tax for their broker members.

Revenue NSW is arguing that mortgage brokers are employees of aggregation groups, who provide them with technology services and act as a clearing house for commissions.

The Yellow Brick Road chairman says real estate agents will be the next industry targeted if the NSW government succeeds with its “tax grab”.

“If they can do it with us, then they will do it with the real estate agents and all of the big builders. It’s a way of massively increasing their tax revenue. But if they do it to us, they will send the industry broke. They will run us out of New South Wales and kill the industry,” Mr Bouris told REB.

The loss of brokers in NSW would have a major impact on real estate agents, who work hand-in-hand with brokers on behalf of millions of home buyers across the state.

If enacted, Mr Bouris believes the majority of borrowers will be forced to go directly to the banks, which could prove difficult given widespread branch closures across the state.

In a letter to Revenue NSW and several members of parliament, the MFAA said the state government has “no legal basis” to hit the broking industry with a payroll tax.

The letter from the MFAA, seen by REB’s sister platform, The Adviser, has gone to several key politicians, including the NSW Premier, NSW Treasurer, Minister for Customer Service, Digital and Small Business, Leader of the Opposition, shadow treasurer, and shadow finance minister.

In it, the association expressed “serious concerns” on behalf of its members in relation to the “unwarranted, unfair, and unreasonable actions undertaken by Revenue NSW regarding the application of the Payroll Tax Act 2007 (the Act) to the mortgage and finance broking industry”.

The MFAA said that the “erroneous and haphazard application of this tax, including retrospective fines and penalties by Revenue NSW threatens the financial stability of the industry”.

You are not authorised to post comments.

Comments will undergo moderation before they get published.