When an investor purchases an investment property, whether it is brand new or an older building, over time some of the items within the property will need to be updated and replaced.

The biggest mistake investor's make when renovating an investment property is to assume there is no value left in the assets they are removing from the property and often these items end up at the tip with little regard to the dollars they could be worth.

Property Professionals need to make their investor clients aware of the significant tax advantages which can be generated over and above a normal depreciation claim when they decide to renovate an investment property.

A process known as scrapping can be applied when any potentially depreciable asset is removed and disposed of from an investment property. Scrapping allows the owner to claim the remaining depreciable value for items being removed within the same financial year as their removal from an investment property.

Before scrapping can be applied, there are a few important points every Property Professional should inform their client about before starting any renovation work on their property:

- When an investor purchases a property, it must be income producing before the owner completes a renovation in order to write-off the value of removed assets

- An investor should arrange a tax depreciation schedule prior to the removal of any structures or assets. This will allow a specialist Quantity Surveyor to value all of the items contained within the property and obtain photographic records to substantiate the owners depreciation claim

- After the renovation has been completed, a second updated depreciation schedule is required to value all new plant and equipment and capital expenditure within the property. This schedule will outline all the claims the investor can make on these new items

Case Study

The following scenario shows how one investor benefited from the additional deductions received when renovating their investment property.

Kelly purchased a fifty year old, two bedroom house. After renting it out for two years, Kelly decided to renovate her property. In its pre-renovation condition, the house contained carpet, blinds, an oven, a cook top, ceiling fans, an air-conditioning unit, a hot water system and light shades.

When Kelly originally purchased the property two years ago she engaged a Quantity Surveyor to complete a tax depreciation schedule. After hearing about the additional deductions available when renovating, Kelly contacted BMT Tax Depreciation to find out more. Kelly found that she was able to use her existing depreciation schedule to work out the remaining depreciable value of items which were to be removed during the renovation.

When the original depreciation schedule was completed, a BMT depreciation expert visited Kelly's house and conducted a full site inspection. During this inspection they took notes and photographic images of all the depreciable items contained in the property.

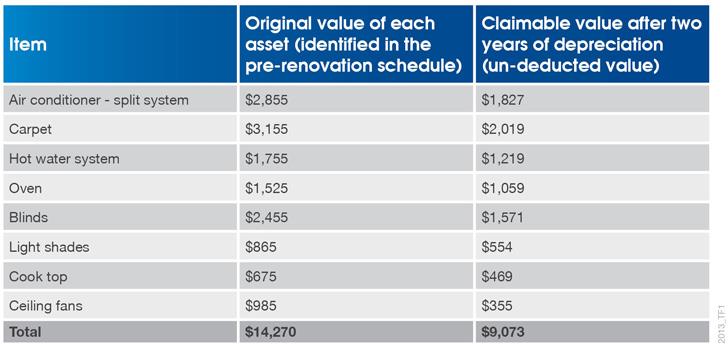

The below table outlines the original value of each asset identified in the original depreciation schedule and the remaining un-deducted depreciable value for these items that could be claimed instantly once these items were removed from the property and scrapped.

Once the renovation was completed, Kelly was able to claim $9,073 in additional deductions in her personal tax return that year. Kelly also requested for BMT Tax Depreciation to update the depreciation schedule for her property once the renovation was completed.

A depreciation expert visited the property to perform a second site inspection and take new evidentiary photos and notes about the additions. The Quantity Surveyor then calculated the construction write-off allowance now available on Kelly's new extension. New assets also included an oven, an air-conditioning unit, a hot water system and blinds. In addition to the $9,073 claimed on the removed assets, Kelly was able to claim $8,700 in depreciation deductions for the newly installed items in the first year alone and $29,300 in the first five years.

More ways Property Professionals can help

BMT Tax Depreciation has created a handy application called BMT Resi Rates which can assist Property Professionals to help their clients to work out when it is appropriate to schedule maintenance, replacement and renovation work on a property.

BMT Resi Rates allows Property Professionals to search and find the depreciation rate and effective life of common depreciable assets found within a residential property. Download Resi Rates today or for more information, contact one of the expert staff at BMT Tax Depreciation on 1300 728 726.

You are not authorised to post comments.

Comments will undergo moderation before they get published.